Capital gains tax rate house sale

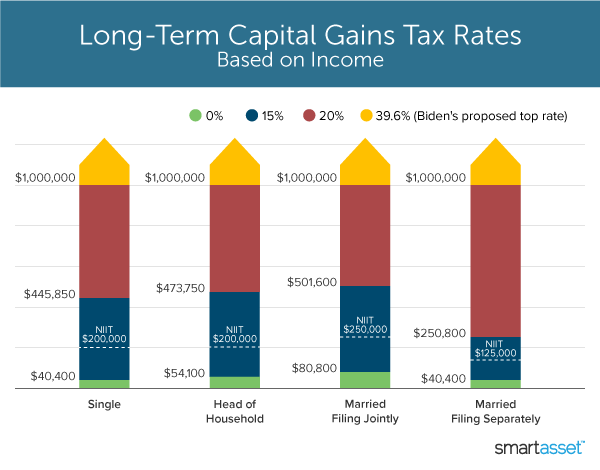

The current long-term capital gains tax rates are 0 15 and 20 depending on income. For example to qualify.

What S In Biden S Capital Gains Tax Plan Smartasset

However an inherited property is not subject to tax implications.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis. To calculate your capital gains tax as a UK resident firstly you need to assess whether the profit made on the property sale is above your tax-free allowance known as the annual exempt. Capital Gain Tax Rates.

Similar to long-term capital gains tax rates for assets sold within a year of ownership depend on your income level. The current capital gain rate of tax on residential property is 20 plus cess and surcharge. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

The tax exemption available would be lower of the following amounts. The rates are much less onerous. Experienced in-house construction and development managers.

28 on your gains from residential property. In general the IRS taxes the profit you make selling your rental property. Amount of capital gain.

Defer taxes with Flocks 1031 DST fund. Some or all net capital gain may be taxed at 0 if your taxable income is. Capital gains taxes on assets held for a year or less.

If youve owned it for more than two years. The tax is only. Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing.

Ad Donate appreciated non-cash assets and give even more to charity. Experienced in-house construction and development managers. Investment made in the new residential house property.

Schwab Charitable makes charitable giving simple efficient with a donor-advised fund. If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021. Many people qualify for a 0 tax rate.

If you pay basic rate Income Tax. For the sale of a second home that youve owned for at least a year the capital gains tax rates for 2019 are 0 percent 15 percent or 20 percent depending on your income in that year including. The tax rate on most net capital gain is no higher than 15 for most individuals.

Capital Gains Tax Rate in California 2022. 20 on your gains from other chargeable assets. Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds.

Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. How much is short-term capital gains tax. Since you owned the home for 10 years the long-term capital gains tax rate would apply.

5 the income range rises slightly to the 41675459750. 2022 capital gains tax rates In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. If you sell a rental property you must pay taxes on the profit or gain you make.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. Retire from being a landlord. Ad Transform your real estate into a managed portfolio of single family homes.

Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home. Short-term capital gains tax rates. 2022 If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021.

Capital gains tax at 0. If you have large gains or. When applying capital gains tax rules to the sale of a business the IRS typically looks.

Everybody else pays either. Here are important capital gains tax rules to keep in mind. The rate you pay would depend on your income and filing status.

Retire from being a landlord.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Capital Gains Tax What Is It When Do You Pay It

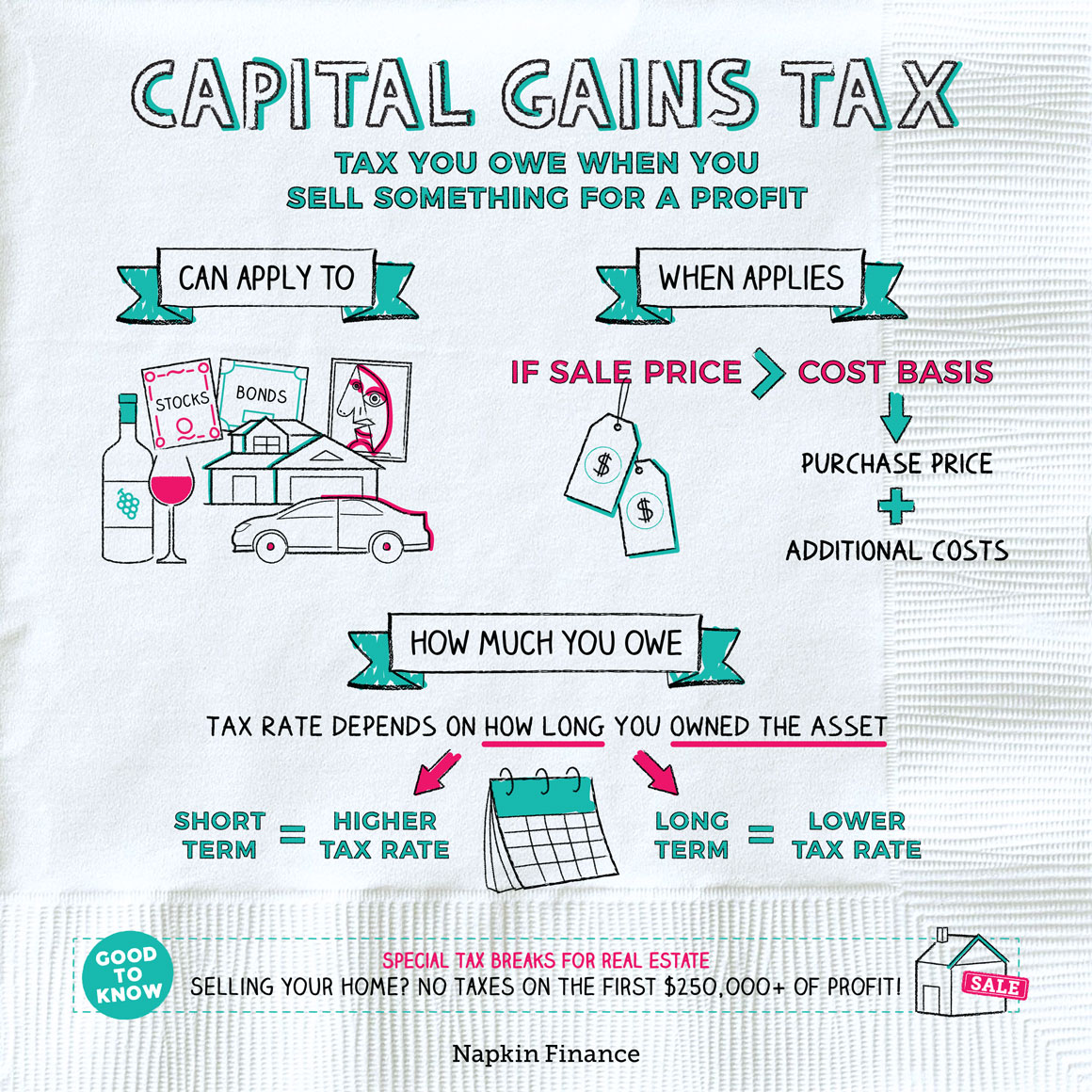

Capital Gains Tax Guide Napkin Finance

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

Capital Gains On Home Sales What Is Capital Gains Tax On Real Estate Guaranteed Rate

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

State Taxes On Capital Gains Center On Budget And Policy Priorities

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

How To Save Capital Gain Tax On Sale Of Residential Property

How Much Tax Will I Pay If I Flip A House New Silver

How High Are Capital Gains Taxes In Your State Tax Foundation

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Capital Gains Tax 101

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax On Home Sales Experian